Fiduciary Basics

Under the Employee Retirement Income Security Act of 1974 (ERISA), every employer/sponsor of a qualified retirement savings plan is deemed to be a fiduciary. As a result, there are certain responsibilities that every business owner and their executives need to be aware of and actively manage when their company sponsors a 401(k) plan.

Definition of a Fiduciary

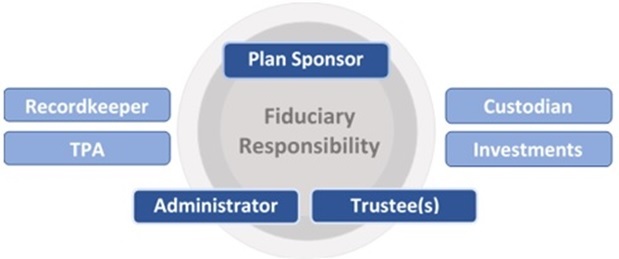

ERISA generally defines a fiduciary as anyone who exercises discretionary authority or control over a plan's management or assets held within the plan, including anyone who provides investment advice to the plan or its agents. For a defined contribution plan – such as a 401(k), the people who fall into this category are usually employees of the sponsoring employer.

ERISA Deemed Fiduciaries:

- Plan Sponsor

- Plan Trustee(s)

- Plan Administrator

- Banks or similar financial institutions

- Registered Investment Advisor(s)

- Insurance Companies

- Trust Custodian(s)

The key to determining whether an individual or an entity is a fiduciary is whether they are exercising discretion or control over the plan. Attorneys, accountants and actuaries generally are not fiduciaries when acting solely in their professional capacities. - U.S. Department of Labor

Therefore, a Fiduciary is anyone who:

- Exercises discretion or exerts control with respect to the management of the plan or disposition of its assets.

- Renders investment advice – directly or indirectly – for compensation, or has the authority or responsibility to do so.

- Has discretionary authority or responsibility for the routine administration of the plan.